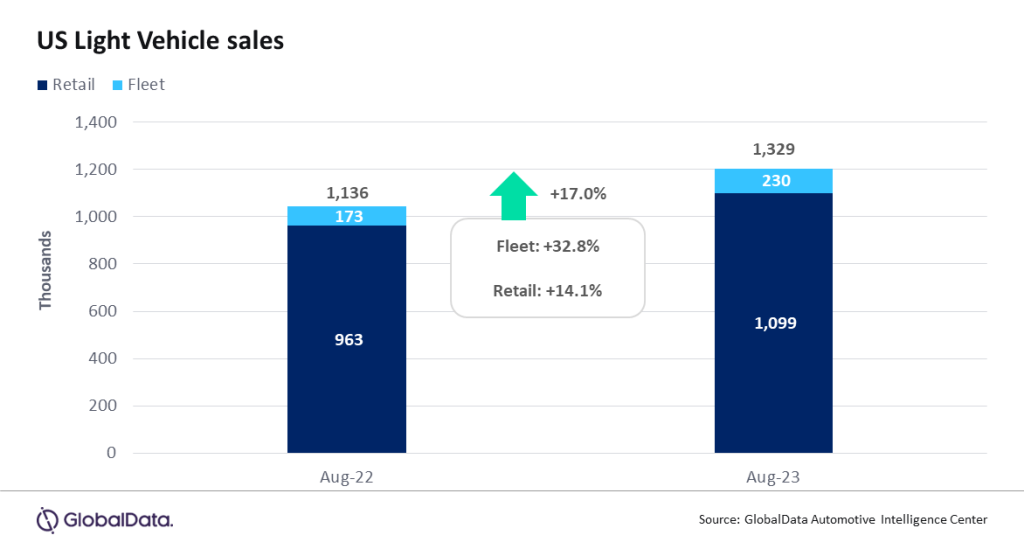

- According to preliminary estimates, LV sales grew by 17.0% YoY in August, to 1.33 million units. Low year-ago sales are still making year-on-year growth relatively easy to achieve. Inventory levels have been trending upwards, while fleet sales are accounting for a higher share of the market, and incentives are increasing, while still remaining well below historical levels.

- Global outlook – The global Light Vehicle selling rate rose for the fifth consecutive month in July, reaching 96.7 million units and outperforming initial expectations for the month. Despite continued year-on-year (YoY) growth, global LV sales volume for July recorded a moderate 7.5% increase following a run of stronger growth over previous months. China took a backseat in July, posting a decline of 6.2% from a year ago. The global automotive market remains resilient and the outlook for 2023 has been increased from 86.4 million units to 86.9 million units, an increase of 7% from 2022. Supporting this improvement, impact from production and supply disruption is less than it was a year ago and volumes continue to improve.

US Light Vehicle sales totaled 1.33 million units in August, according to GlobalData. The annualized selling rate slowed from 15.8 million units/year in July, to 15.0 million units/year in August. August’s daily selling rate was estimated at 49,200 units/day, compared to 52,200 units/day in July. Therefore, the market did seem to cool off in the final month of the summer, although Labor Day could yet provide a boost in September. According to initial estimates, retail sales totaled around 1,099,000 units, while fleet sales accounted for approximately 230,000 units, representing around 17.3% of total sales.

David Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “August sales continued many of the same themes of recent months: improving inventory, stronger fleet sales and some degree of relief on pricing compared to a year ago helped to spur YoY growth. However, sales missed our expectations, which could have been a result of consumers holding back to see if dealers would offer more attractive deals as the Labor Day weekend – which will be counted in September sales this year – approached. Another curveball in August was the extreme weather that was experienced first in California and then in Florida, which could have trimmed sales activity at the margins”.

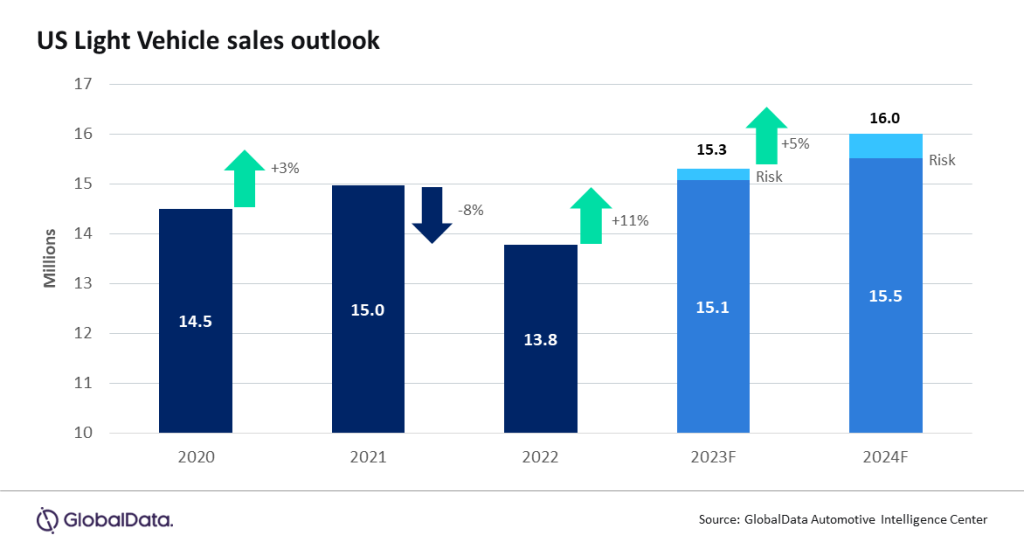

Given August’s volume missed expectations and a UAW strike is appearing to be imminent, we have taken the edge off the forecast for Light Vehicle sales in 2023, cutting the year from 15.4 million units to 15.3 million units. The forecast for 2024 remains at 16.0 million units, but some volume was shifted into 2024 from 2023 as a hedge.

Vehicle days’ supply remains suppressed but is estimated to have grown slightly in August to 39 days from 34 in July, but has risen from 29 days a year ago. A weaker daily selling rate and less disruption in vehicle production contributed to the increase in inventory.

At an OEM level, GM once again comfortably led the market in August, with 230k units representing a market share of 17.3%, its highest since January. Toyota Group was second in the rankings, but around 35k units behind GM. Toyota Group’s share was 14.7%, little changed from July, but significantly up on its performance earlier in the year. Ford Group was the third bestselling OEM in August, but its market share was only 11.6%, its lowest since August 2021. For the first time since October 2022, the Ford F-150 was usurped from its market-leading position by the Toyota RAV4, which sold around 300 more units. While the F-150 saw its weakest sales since February 2023 (39.6k units), the RAV4 enjoyed its highest volumes since July 2021 (39.9k units). As has become customary, the Compact Non-Premium SUV segment led the way in August, with a 19.9% share, ahead of Midsize Non-Premium SUV on 14.9% and Large Pickup on 13.8%.

Jeff Schuster, Automotive Group Head and Executive Vice President, GlobalData, said: “While the magnitude of the reduction in the forecast for 2023 is more symbolic than an outright shift in the expected recovery pattern, it does signal some risk in both demand and supply are on the horizon. Pricing remains elevated and we could be reaching a point where consumers simply hold off on purchases given affordability factors. In addition, a potential strike is seeming more likely, which could derail the inventory rebuilding and higher level of fleet sales recovery.”