The Chinese Light Vehicle sales pace slowed slightly in July. Light Vehicle wholesales came to 2.37 million units with growth of -3% year-on-year. At a component level, total Personal Vehicle wholesale volume reached 2.14 million units, down by 3% year-on-year in the month. At the same time, the Light Commercial Vehicle segment continued to grow, increasing by 5% year-on-year to a total of 231k units. On a month-on-month basis, July Personal Vehicle sales decreased by 7%, while Light Commercial Vehicle sales decreased by 13%. Since the beginning of this year, cumulative Light Vehicle wholesales have reached 15.39 million units, an increase of 7%. At a glance, July sales declined both from a year-on-year and month-on-month perspective. But considering last year’s abnormally strong post-lockdown sales in July 2022 (hence a high base), the fact that June’s sales broke the record high in 2023 and combining this with seasonal factor considerations, July’s sales remained surprisingly robust. The July selling rate reached 35.9 million units/year, the second-highest rate on record.

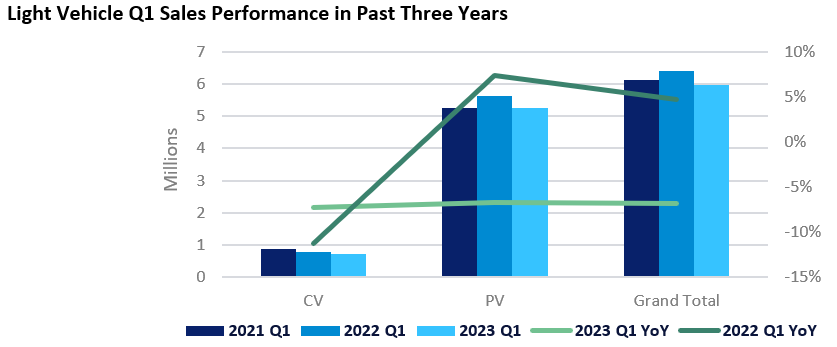

Expectations for China’s economic recovery have been high since the end of the zero-COVID policy in December last year, but in reality, the economic performance in the first quarter of 2023 was seriously worse than expected. Although China’s GDP achieved growth in the first half of the year, many major economic indicators fell short of expectations. Momentum in China’s economic recovery is following a continuously slowing trend. Data show that in the first half of 2023, the national consumer price index (CPI) rose by 0.7% year-on-year, the growth rate remaining below 1% for four consecutive months. The producer price index (PPI) fell 3.1 per cent year-on-year, the monthly decline accelerating with the latest data marking the sixth consecutive month of decline. From a macro data perspective, the clear inference is that the phenomenon of insufficient demand is taking place as domestic prices continue to run at a low level. The situation is even triggering concern that the economy may fall into deflation. In addition to the sluggish macro market performance, a price war among major OEMs was started in March, triggered by the price reduction of Citroën’s C6. The chaos of the price war has led to consumers adopting a wait-and-see attitude. This contributed to China’s auto sales falling by 6.81% year-on-year in the first quarter of this year. Given the subdued macro environment and noises in the market, our forecast for the first half of the year was conservative.

Sales in the first quarter of 2023 were seriously lower than expected and market sentiment was depressed, leading local governments to successively begin small-scale local subsidy policies to promote the development of the auto market, but the effect was not significant. Since June, the Chinese central government has rolled out a package of policies aimed at boosting consumption and releasing domestic demand. On 16 June 2023, the central government launched the “2023 NEVs (New Energy Vehicles) to the Countryside” policy. At the end of June, the three relevant government departments jointly announced the continuation and optimisation of the purchase tax reduction policy for NEVs, indicating that the current purchase tax reduction for NEVs will be extended by four years to the end of 2027.

On 25 July, to further stabilise and expand automobile consumption and promote the sustainable recovery of consumption, the central government published the new “Study and Formulate Several Measures to Promote Automobile Consumption” report. In addition to policies targeting the auto industry, on 28 July the General Office of the State Council forwarded a notice from the National Development and Reform Commission on “Measures to Restore and Expand Consumption”. Following the policy of “recognise housing but not mortgage” (to regulate the real estate market) in first-tier cities in China and the policy of lower interest rates on existing mortgages for first-home loans, market sentiment has changed completely. There are signs that sentiment is gradually turning positive and there are obvious signs of recovery in consumption and demand.

This change in market sentiment is an important signal. With the gradual implementation of the package of policies mentioned above, these changes will support automotive sales in the second half of the year and continue the growth trend seen in June and July. Hence, we have raised the 2023 sales forecast by 360k units but left the rest of the forecast unchanged. We now expect LV sales to increase by 3.8% to 27.8 million units in 2023. However, due to the high base in the second half of 2022, although sales in the second half of 2023 are expected to remain at an elevated level, there is also likely to be a negative year-on-year growth in that period.

2023 is a unique year. Provincial and local subsidies have been in place since March, but all had a negligible effect on the market. Also, there are signs that a new round of the price war between OEMs will take off. Valid questions include how the policies published in June and July will support the market and whether a renewed price war will increase consumers’ wait-and-see attitude. Although there are still many uncertainties in the second half of the year, we believe that the recovery in market confidence will promote growth in the auto market.

Kevin Zeng, Light Vehicle Market Analyst, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center