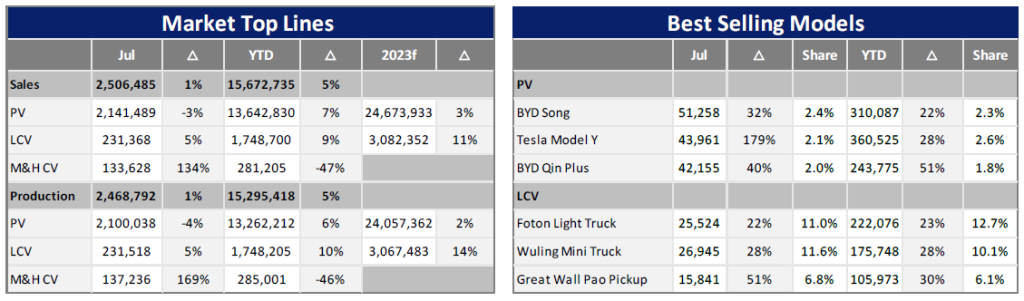

The Light Vehicle (LV) production and sales pace slowed slightly in July in the Chinese market. LV wholesales (which include sales allocated for export) came to 2.37 million units, down 3%. At a component level, total Personal Vehicle (PV) wholesale volume reached 2.14 million units, down by -3% in the month. At the same time, the Light Commercial Vehicle (LCV) segment kept growing, increasing by 5% year-on-year (YoY) to a total of 231k units. On a month-on-month (MoM) basis, PV sales decreased by 7%, and LCV sales decreased by 13% in July. Since the beginning of this year, cumulative LV wholesales have reached 15.39 million units, an increase of 7%. On the production side, total China LV production in July was 2.33 million units, decreasing by 3% YoY and 5% MoM.

Year-to-date (YTD) LV production was 15.01 million units, increasing by 7% YoY. Within this figure, PV output in July was down by 4% YoY with a total volume of 2.10 million units. LCV output was 231k units in July, up 5% YoY and increasing by 10% YTD. July is usually a slow season for production, and when coupled with strong market growth in the same period last year under the ICE car purchase tax incentives policy, the output in July 2023 resulted in a slight decline in MoM and YoY terms.

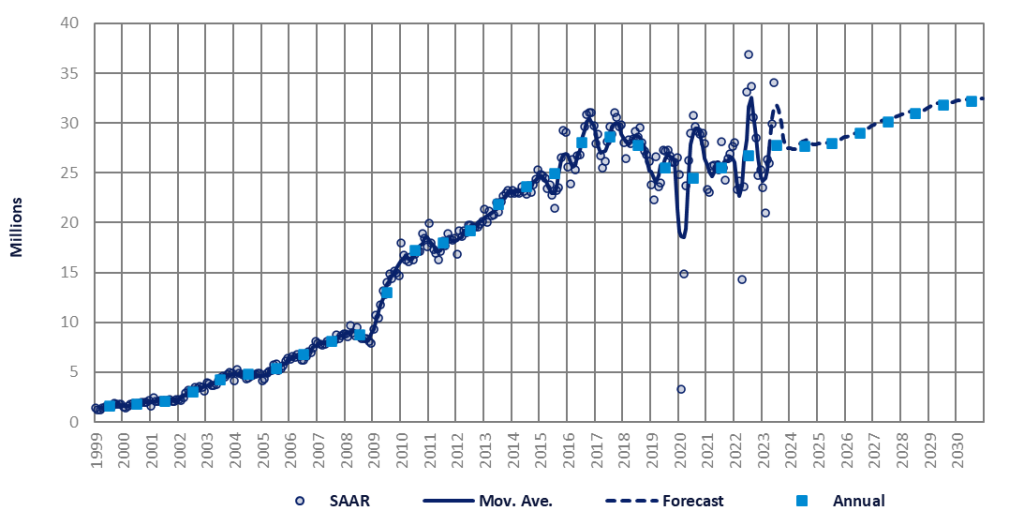

The July selling rate reached 35.1 million units/year, the second highest rate on record, behind the abnormally strong post-lockdown rate of July 2022. In YoY terms, sales (i.e., wholesales, which include exports) declined by nearly 5%, but that was due to the unusually high year-ago level. In the first seven months of this year, the selling rate averaged 28 million units/year and deliveries to dealerships increased by 6.7%.

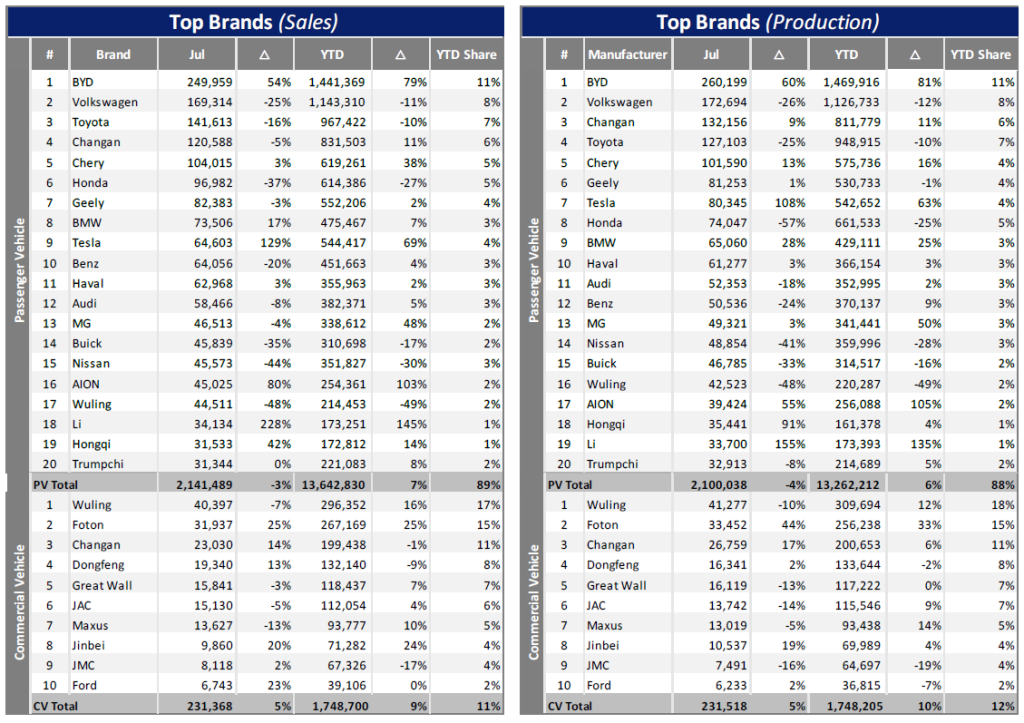

In the current weak economic environment, the overall auto market is gradually showing a greater level of performance differentiation between OEMs. From January to July of 2023, BYD’s market share grew to 9.4%. It has now overtaken Volkswagen (at 7.4%) to become the number one brand in China.

In July, the market didn’t show the typical characteristics of the off-season. Although slightly lower than the same period last year, the market performance in July 2023 was still better than expected. This trend is thought to have continued in August. So the 2023 full-year forecast in China has been raised by 354k units, which brings it to around 27.7 million units with growth of 3.8% YoY. As the outturn in the second quarter of this year was much higher than expected, and the central government has proposed specific measures to promote automobile consumption, production is expected to continue to increase in the second half of 2023. However, for the general economic environment, we do not see significant positive signals at the moment, so we have not increased the forecast for the 2024 to 2025 period.

So far in 2023, the central government has not announced any subsidies for conventional fuel cars (ICE). By contrast, the government’s support for the development of NEVs (New Energy Vehicles) is obvious and the decline of ICE cars in China will accelerate. It should be noted that the structure of the policy of gradual ICE decline over time has increased government influence over the price ceiling of models. While continuing to promote the development of the NEV market and stimulate consumption of new energy products, it has a stronger guiding role in the pricing strategy of manufacturers and hence the choice of which vehicles consumers will buy. NEVs remain the market driver. In July 2023, NEV sales increased by 3.3% compared with June and total volume increased by 33% YoY. The proportion of BEVs (Battery Electric Vehicles) within NEV sales reached 67% and the share of PHEVs (Plug-in Hybrid Electric Vehicles) has increased rapidly while EREVs (Extended Range Electric Vehicles) are becoming a key player.

In July some new EREV models were launched and the competition and attractive pricing have engaged a growing number of consumers. Among PV wholesales (which include exports), the three best-selling models were the BYD Song, Tesla’s Model Y and BYD’s Qin Plus – all NEVs. (Note, about half of Tesla wholesales were for export.) However, NEV sales growth has moderated, compared to the triple-digit percent expansion seen last year. In H1 of 2023, Chinese NEV brands continued to advance, with their sales surging strongly. In contrast, sales of non-Chinese brands (the traditional ICE makers, such as VW, Toyota and Honda) recorded YoY declines.

Exports accounted for about 15% of July passenger vehicle sales, while domestic sales were sluggish. PV exports reached 320k units in July, increasing by 38% YoY, and now accounting for 12% of total PV production. Total PV exports YTD in 2023 reached 2.07 million units, an increase of 81% YoY. Chery, SAIC, Tesla, Geely and Great Wall are the leading PV exporters, and most of China’s PV exports went to Russia, the EU, the Middle East and South East Asia markets.