Summary

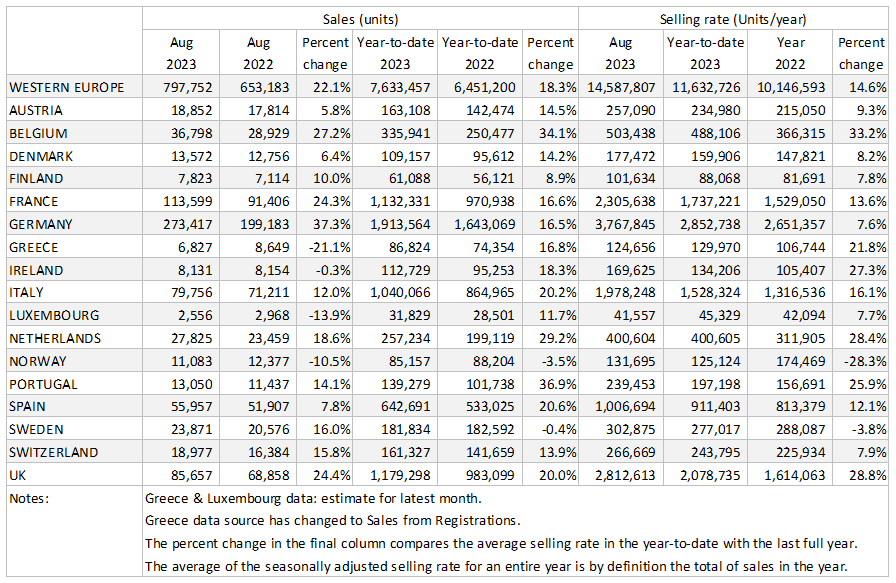

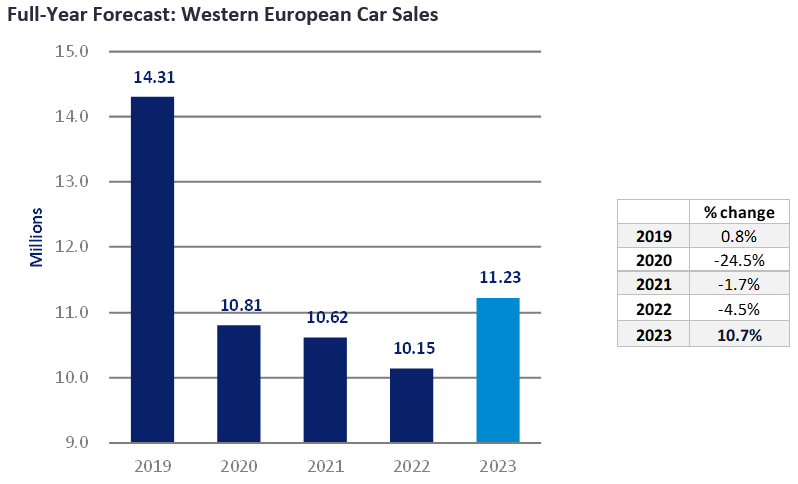

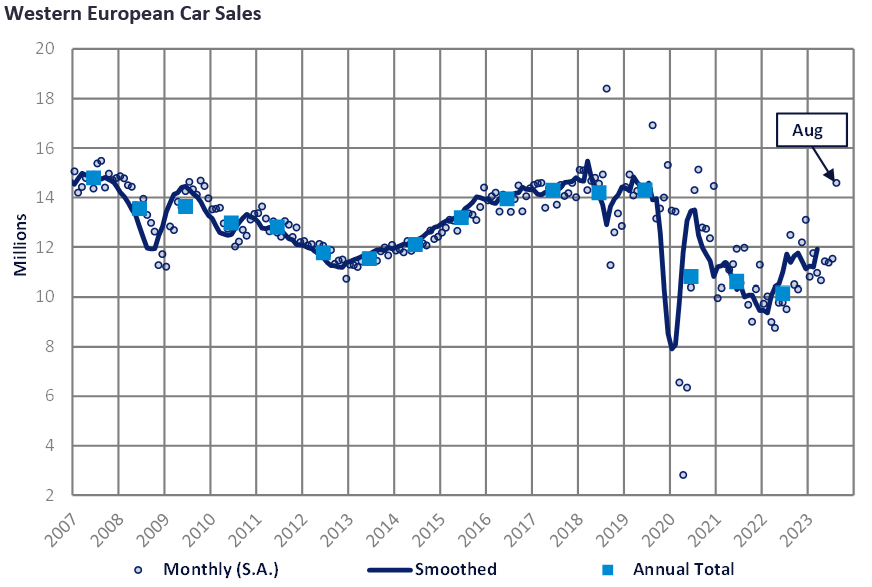

- The Western Europe PV selling rate rose to 14.6 mn units/year in August, up from 11.5 mn units/year in July, making it the best result of the year so far. Registrations stood at nearly 800k units, representing an increase of 22% YoY. The supply situation continues to improve but the market is still performing well below 2019 levels.

- France performed extremely well, with the highest selling rate since 2019 of 2.3 mn units/year. While this is inflated by the easing of supply constraints, the market is performing considerably better than in 2022, with year-to-date (YTD) growth standing at almost 17%. The UK also performed well relative to last year.

- For another month, all the top five Western European markets, barring Spain, experienced double digit YoY growth for August 2023. The macroeconomic environment remains challenging as countries face high interest rates and subdued economic growth. However, with backlogs, and 2022 being a low base, growth remains our core assumption, with 2023 expected to reach 11.2 mn units.

Commentary

The Western Europe PV selling rate rose to 14.6 million units/year in August, with the total raw monthly vehicle registrations at 800k units (+22% YoY). The market selling rate for the five major West European countries was strong in August, partly due it being a seasonally weak month that saw improved vehicle supply inflating the result. Year-to-date (YTD) the region has sold 7.6 million vehicles which is 18% higher than the YTD August 2022 total.

The German PV market performed stronger than expected in August 2023 with 273k units sold, 37.3% higher than the same period last year and with a selling rate of 3.8 million units/year. The market has sold 1.9 million vehicles YTD – 16.5% higher than the YTD August 2022 total. The UK PV market continued to grow strongly with the selling rate reaching a yearly high of 2.8 million units/year, after registering 85.7k units (+24.4% YoY). While this growth is supported by large fleet and business registrations, private demands has softened. August is a relatively weak month as consumers wait for the new plates in September. The UK PV market sold 1.2 million vehicles YTD, 20% higher than the YTD August 2022 total.

The French PV market posted a strong selling rate last month, at 2.3 million units/year — registrations stood at 114k units (+24.3% YoY) with YTD sales at 1.1 million units, 16.6% higher than the YTD August 2022 total. The Italian PV market sold 80k units in August, up 12% YoY and with a selling rate of 2 million units/year. The market continues its strong upward YoY growth trend; however, it is to be noted that 2022 was a weak base of comparison. Spain’s PV market selling rate rose from 860k units/year in July to 1 million units/year in August 2023, with total sales at 56k units (+7.8% YoY). These sales figures were driven by an easing in supply issues but also assisted by demand in the summer holiday period. The market sold 643k units YTD – 20.6% higher than YTD August 2022.